Navigating the Jewels of the Indian Stock Market: An Exploration of Jewellery Shares

Related Articles: Navigating the Jewels of the Indian Stock Market: An Exploration of Jewellery Shares

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Jewels of the Indian Stock Market: An Exploration of Jewellery Shares. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Jewels of the Indian Stock Market: An Exploration of Jewellery Shares

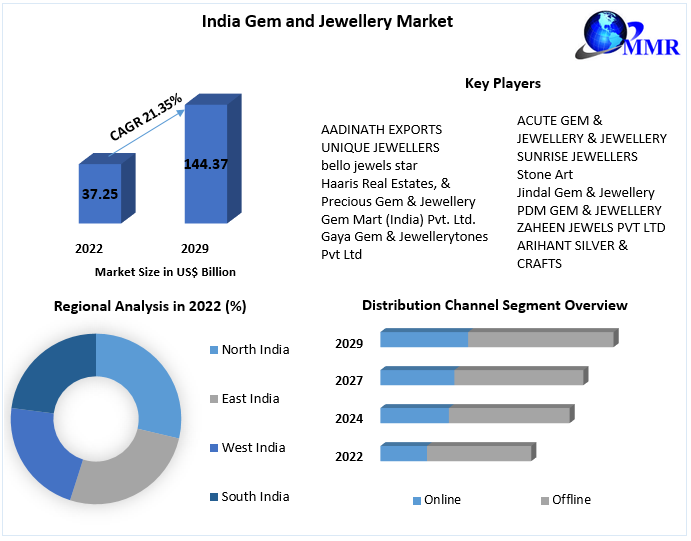

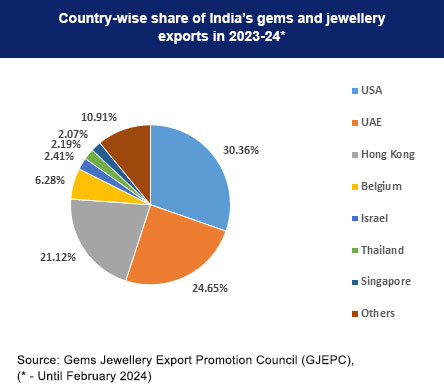

The Indian jewellery market, a vibrant tapestry of tradition and modern aesthetics, has long captivated investors. As a significant contributor to the country’s economy, the sector offers a compelling investment opportunity, attracting both seasoned investors and newcomers seeking to diversify their portfolios. This article delves into the intricacies of investing in jewellery shares in India, providing a comprehensive overview of the sector, its key players, and the factors influencing its performance.

Understanding the Indian Jewellery Market: A Mosaic of Tradition and Modernity

India’s jewellery market is a vast and multifaceted landscape, encompassing a diverse range of products, from intricate traditional ornaments to contemporary designs. This market thrives on a strong cultural foundation, where jewellery holds deep-rooted significance in social, religious, and personal spheres.

Key Drivers of Growth:

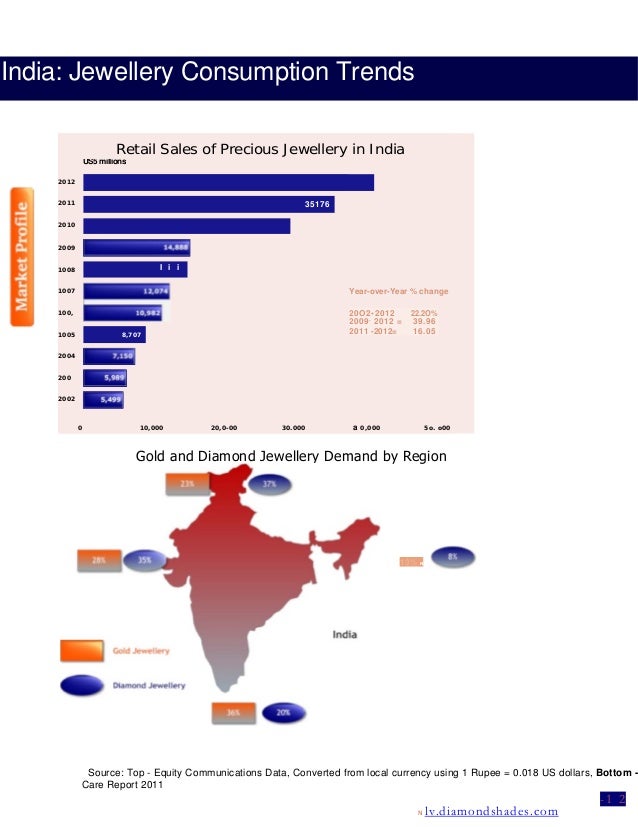

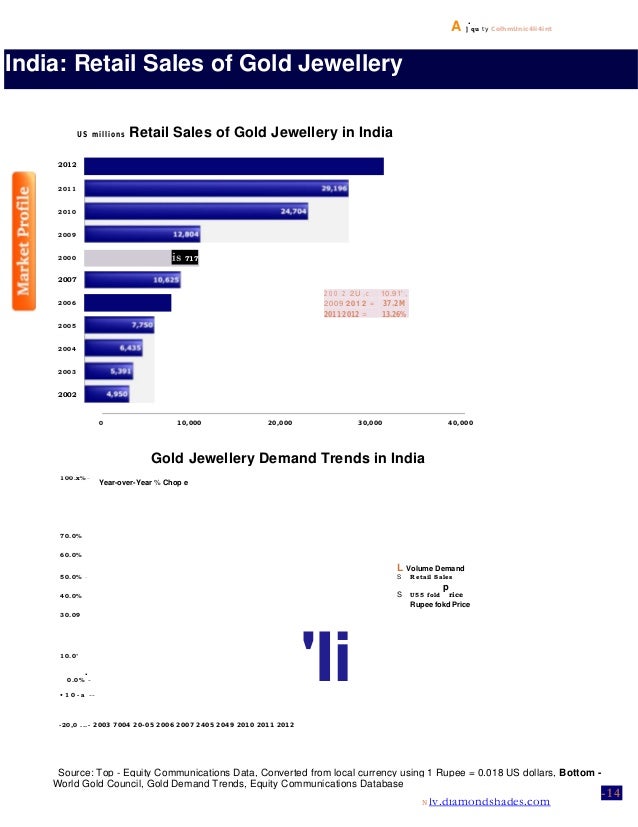

- Growing Middle Class: India’s burgeoning middle class, with its increasing disposable income, fuels demand for jewellery, especially gold, seen as a safe haven asset and a symbol of prosperity.

- Festivals and Occasions: The Indian calendar is replete with festivals and special occasions, each marked by elaborate jewellery traditions, driving significant demand.

- Urbanization and Rising Disposable Income: Urbanization and rising disposable incomes in tier-II and tier-III cities are expanding the market reach and increasing consumer spending on jewellery.

- Evolving Trends: The rise of e-commerce platforms and changing consumer preferences are driving innovation and diversification within the jewellery sector, encompassing contemporary designs and personalized pieces.

Exploring the Landscape of Jewellery Shares in India

The Indian stock market features a diverse range of companies involved in the jewellery business, encompassing manufacturers, retailers, and distributors. These companies are categorized into two main segments:

1. Organized Sector: This segment comprises listed companies with established manufacturing facilities, retail networks, and robust financial structures. These companies often operate on a larger scale, adhering to industry standards and regulatory compliance.

2. Unorganized Sector: This segment includes smaller, locally-operated businesses, often family-owned, that operate primarily in the traditional jewellery market. They may lack formal financial reporting and regulatory oversight.

Key Players in the Indian Jewellery Market:

- Titan Company Limited: A leading player in the organized sector, Titan Company is renowned for its diversified product portfolio, including watches, jewellery, and eyewear. It operates under various brands, including Tanishq, Zoya, and Mia, catering to different segments of the market.

- PC Jeweller Limited: A prominent jewellery retailer with a strong presence in the northern and western regions of India, PC Jeweller is known for its extensive network of stores and its focus on gold and diamond jewellery.

- Thangamayil Jewellery Limited: A leading player in the south Indian market, Thangamayil Jewellery offers a wide range of traditional and contemporary jewellery designs, with a focus on gold and silver ornaments.

- Gitanjali Gems Limited: A well-established jewellery retailer with a global presence, Gitanjali Gems offers a diverse range of jewellery products, including diamond and gemstone pieces.

- Kalyan Jewellers India Limited: A leading player in the south Indian market, Kalyan Jewellers is known for its focus on gold and diamond jewellery, offering a wide range of designs and styles.

Factors Influencing the Performance of Jewellery Shares:

- Gold Prices: As gold is a primary component of most jewellery, its price fluctuations have a significant impact on the profitability of jewellery companies.

- Consumer Sentiment: Consumer spending on jewellery is influenced by economic conditions, inflation, and overall consumer sentiment.

- Competition: The Indian jewellery market is highly competitive, with a large number of players vying for market share.

- Government Policies: Government policies related to import duties, excise taxes, and regulations on gold imports can influence the cost of raw materials and the overall profitability of jewellery companies.

- Retail Expansion: The expansion of retail networks, both online and offline, plays a crucial role in driving sales and market reach.

Investing in Jewellery Shares: A Strategic Approach

Investing in jewellery shares requires a careful understanding of the sector’s dynamics, market trends, and the specific characteristics of individual companies.

Tips for Investing in Jewellery Shares:

- Thorough Research: Before investing in any jewellery share, it is crucial to conduct thorough research, analyzing the company’s financial performance, market share, brand reputation, and future growth prospects.

- Understanding the Business Model: Investors should understand the specific business model of each company, including its manufacturing processes, distribution channels, and target customer segments.

- Analyzing the Management Team: Assessing the experience and expertise of the management team is crucial, as it plays a significant role in the company’s strategic direction and operational efficiency.

- Monitoring Industry Trends: Staying abreast of industry trends, including changes in consumer preferences, technological advancements, and regulatory developments, is essential for informed investment decisions.

- Diversification: Diversifying investments across different jewellery companies and sectors can help mitigate risks and optimize portfolio returns.

Frequently Asked Questions (FAQs) about Jewellery Shares in India:

1. What are the risks associated with investing in jewellery shares?

Investing in jewellery shares carries inherent risks, including:

- Gold Price Volatility: Fluctuations in gold prices can significantly impact the profitability of jewellery companies.

- Competition: The highly competitive nature of the market can affect pricing and profitability.

- Economic Downturn: Economic recessions can impact consumer spending on discretionary items like jewellery.

- Regulatory Changes: Changes in government policies can affect the cost of raw materials and the overall profitability of jewellery companies.

2. How can I identify promising jewellery shares?

Identifying promising jewellery shares requires a combination of research, analysis, and understanding of the sector’s dynamics. Factors to consider include:

- Strong Financial Performance: Look for companies with a history of profitability, consistent revenue growth, and sound financial management.

- Market Leadership: Consider companies with a significant market share, a strong brand reputation, and a proven track record of success.

- Innovation and Growth Potential: Seek out companies that are investing in innovation, expanding their product lines, and exploring new markets.

- Experienced Management Team: Look for companies with a competent and experienced management team capable of navigating industry challenges and driving growth.

3. What are the long-term prospects for the Indian jewellery sector?

The Indian jewellery sector is expected to witness continued growth, driven by several factors:

- Growing Middle Class: The expanding middle class will continue to fuel demand for jewellery, especially gold, as a symbol of prosperity and wealth.

- Urbanization and Rising Disposable Income: Urbanization and rising disposable incomes will expand the market reach and increase consumer spending on jewellery.

- Evolving Trends: The rise of e-commerce platforms and changing consumer preferences are driving innovation and diversification within the jewellery sector, leading to new product offerings and market opportunities.

4. Are jewellery shares a good investment for long-term wealth creation?

Jewellery shares can be a part of a well-diversified investment portfolio, offering potential for long-term wealth creation. However, it’s crucial to conduct thorough research, understand the risks involved, and consider the investment’s alignment with your overall financial goals and risk tolerance.

Conclusion: Navigating the Glittering Landscape

Investing in jewellery shares in India presents a unique opportunity to participate in a vibrant and dynamic sector. By understanding the market dynamics, key players, and influencing factors, investors can make informed decisions and potentially reap the benefits of this growing industry. As the Indian economy continues to grow and consumer spending on jewellery remains strong, the jewellery sector is poised for continued growth, offering investors the chance to own a piece of this glittering landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Jewels of the Indian Stock Market: An Exploration of Jewellery Shares. We appreciate your attention to our article. See you in our next article!