Navigating the Sparkle: A Comprehensive Guide to Jewellery Sector Stocks in India

Related Articles: Navigating the Sparkle: A Comprehensive Guide to Jewellery Sector Stocks in India

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Sparkle: A Comprehensive Guide to Jewellery Sector Stocks in India. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Sparkle: A Comprehensive Guide to Jewellery Sector Stocks in India

India’s jewellery sector, a vibrant tapestry woven with tradition and modern aesthetics, is a significant contributor to the country’s economy. This sector, encompassing a wide range of businesses from raw material sourcing to retail, presents compelling investment opportunities for discerning investors. This article delves into the intricacies of the Indian jewellery sector, providing a comprehensive guide to understanding and navigating the investment landscape.

The Allure of the Indian Jewellery Market:

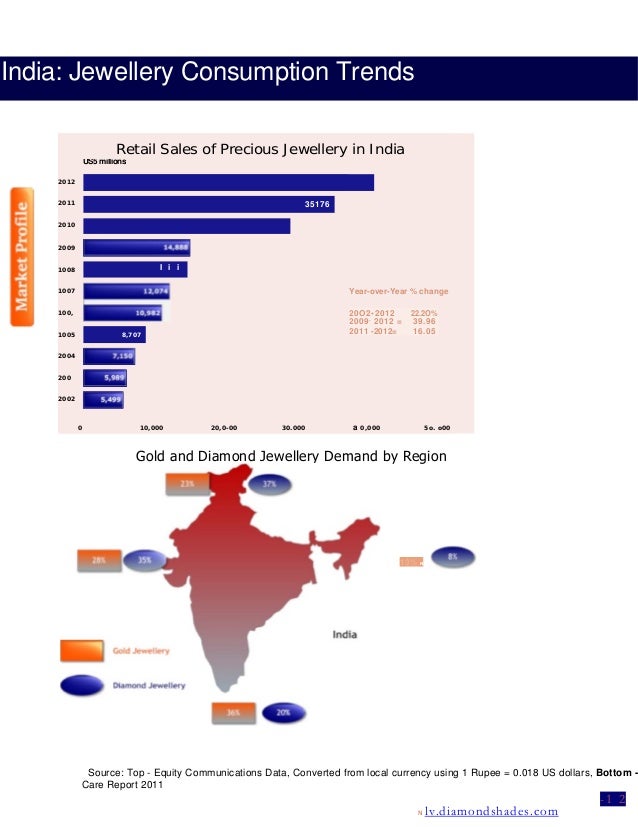

India’s fascination with jewellery is deeply ingrained in its cultural fabric. Jewellery holds immense sentimental value, symbolizing prosperity, beauty, and tradition. This inherent demand, coupled with a growing middle class and rising disposable incomes, has fueled the remarkable growth of the Indian jewellery market.

Key Drivers of Growth:

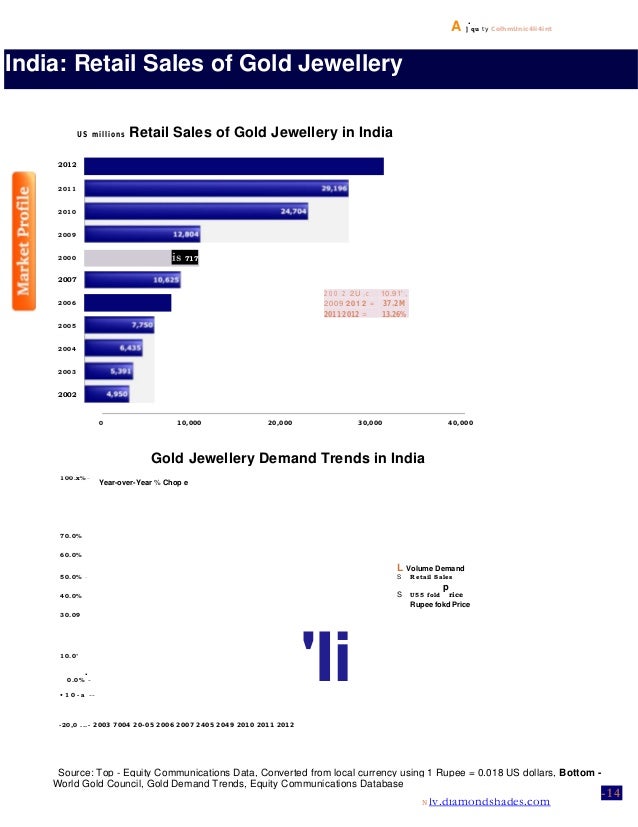

- Cultural Significance: Jewellery forms an integral part of various religious ceremonies, weddings, and festivals. This cultural significance ensures a consistent demand for gold and diamond jewellery.

- Rising Disposable Income: India’s economic growth has led to a substantial increase in disposable income, allowing consumers to allocate a larger portion of their spending towards discretionary items like jewellery.

- Urbanization and Modernization: Rapid urbanization and modernization have fueled a shift towards contemporary and designer jewellery, further expanding the market.

- Emerging Trends: The rise of online platforms and e-commerce has democratized access to jewellery, making it more accessible and convenient for consumers.

Understanding the Indian Jewellery Sector:

The Indian jewellery sector encompasses a diverse range of companies, each playing a crucial role in the value chain. Understanding these segments is essential for investors seeking to make informed decisions:

1. Raw Material Sourcing:

- Gold Mining Companies: India primarily imports gold, making companies involved in gold mining a less prominent segment in the stock market.

- Diamond Processing and Trading: India is a global hub for diamond processing and trading, with companies like Diamond Power, Hari Krishna Exports, and KGK Group playing a significant role.

2. Jewellery Manufacturing:

- Large Organized Players: Companies like Titan Company, PC Jeweller, and Gitanjali Gems dominate the organized jewellery manufacturing sector, offering a wide range of gold and diamond jewellery.

- Unorganized Sector: A significant portion of the jewellery manufacturing sector remains unorganized, comprising small-scale workshops and artisans.

3. Retail:

- Organized Retail Chains: Titan Company, Kalyan Jewellers, and Tanishq are prominent players in the organized retail segment, offering a branded and standardized experience.

- Unorganized Retail: Independent jewellers and local shops form a substantial part of the retail landscape, catering to specific regional preferences.

4. E-commerce:

- Online Jewellery Retailers: Companies like BlueStone, CaratLane, and Melorra have emerged as significant players in the online jewellery market, offering convenience and a wider selection.

Jewellery Sector Stocks in India: A Deep Dive:

Titan Company:

- Leading Player: Titan Company is the largest listed jewellery retailer in India, known for its brands Tanishq and Zoya.

- Integrated Business Model: The company operates an integrated model, encompassing jewellery manufacturing, retail, and distribution.

- Strong Brand Equity: Titan Company boasts a strong brand reputation built on quality, design, and trust.

- Diversified Portfolio: The company also operates in the watch, eyewear, and fragrances segments, providing diversification.

PC Jeweller:

- Large Organized Retailer: PC Jeweller is a prominent player in the organized jewellery retail segment, known for its vast network of stores.

- Focus on Gold Jewellery: The company primarily focuses on gold jewellery, catering to a wide range of customers.

- Expansion Strategy: PC Jeweller is aggressively expanding its retail footprint through new store openings and acquisitions.

Kalyan Jewellers:

- South Indian Focus: Kalyan Jewellers is a leading jewellery retailer with a strong presence in South India, known for its traditional designs.

- Growing National Presence: The company is expanding its reach across India, aiming to become a national player.

- Focus on Value for Money: Kalyan Jewellers positions itself as a value-for-money option, offering competitive pricing and attractive designs.

Gitanjali Gems:

- Diamond Jewellery Specialist: Gitanjali Gems is a leading player in the diamond jewellery segment, known for its exquisite designs and craftsmanship.

- Global Presence: The company has a strong global presence, with operations in several countries.

- Focus on Innovation: Gitanjali Gems is known for its innovative designs and its commitment to using cutting-edge technology.

Investing in Jewellery Sector Stocks: Key Considerations:

- Gold Prices: Gold prices are a significant factor influencing the performance of jewellery sector stocks. Fluctuations in gold prices can impact both revenues and margins.

- Demand Patterns: Understanding the demand for jewellery, driven by factors like cultural events, economic conditions, and consumer sentiment, is crucial for investment decisions.

- Competition: The jewellery sector is highly competitive, with both organized and unorganized players vying for market share.

- Regulatory Landscape: Government policies and regulations related to gold imports, taxes, and import duties can impact the sector’s profitability.

- Financial Performance: Investors should carefully analyze the financial performance of jewellery companies, focusing on revenue growth, profitability, debt levels, and cash flow.

FAQs About Jewellery Sector Stocks in India:

1. Are jewellery sector stocks a good investment?

Jewellery sector stocks can be a good investment, but it is essential to approach them with a long-term perspective and a thorough understanding of the sector’s dynamics.

2. What are the risks associated with investing in jewellery sector stocks?

Risks include volatility in gold prices, competition, regulatory changes, and the cyclical nature of demand.

3. Which jewellery stocks are currently performing well?

The performance of jewellery stocks can fluctuate. It is advisable to conduct thorough research and consult with a financial advisor before making any investment decisions.

4. How can I track the performance of jewellery sector stocks?

Investors can track the performance of jewellery sector stocks through financial news websites, stock market data providers, and investment platforms.

5. Are there any specific factors that I should consider when investing in jewellery sector stocks?

Consider factors like the company’s brand reputation, financial performance, market share, and growth strategy.

Tips for Investing in Jewellery Sector Stocks:

- Conduct Thorough Research: Gain a comprehensive understanding of the sector, including the key players, market trends, and regulatory environment.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in a diversified portfolio of stocks across different sectors to mitigate risk.

- Focus on Long-Term Growth: Jewellery sector stocks can be volatile, so focus on long-term growth potential rather than short-term gains.

- Consult with a Financial Advisor: Seek professional guidance from a qualified financial advisor to develop a personalized investment strategy.

Conclusion:

India’s jewellery sector offers a unique blend of tradition and modern trends, making it a dynamic and exciting investment landscape. By understanding the key drivers of growth, the diverse segments within the sector, and the risks associated with investing in jewellery stocks, investors can make informed decisions and potentially reap the rewards of this vibrant market. However, it is crucial to conduct thorough research, diversify investments, and consult with financial professionals to navigate this complex and often volatile sector effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Sparkle: A Comprehensive Guide to Jewellery Sector Stocks in India. We hope you find this article informative and beneficial. See you in our next article!