Understanding the Fluctuating Landscape of Gold and Silver Prices in India

Related Articles: Understanding the Fluctuating Landscape of Gold and Silver Prices in India

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Fluctuating Landscape of Gold and Silver Prices in India. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Fluctuating Landscape of Gold and Silver Prices in India

India, a nation deeply rooted in tradition and cultural heritage, holds a profound connection with gold and silver. These precious metals are not merely commodities but integral elements of societal customs, religious practices, and personal investments. As such, understanding the dynamics of their prices is crucial for individuals, businesses, and the overall economy.

This article delves into the factors that influence the current gold and silver rates in India, highlighting the key players and trends shaping this dynamic market. It explores the significance of these rates, their impact on various sectors, and the importance of staying informed about their fluctuations.

Factors Influencing Gold and Silver Rates in India:

1. Global Market Dynamics:

The global market serves as the primary driver of gold and silver prices in India. International demand and supply forces, geopolitical events, and economic conditions significantly impact the international rates, which in turn influence domestic prices.

- Demand: The global demand for gold and silver arises from various sectors, including jewelry, technology, investment, and central bank reserves. Increased demand often leads to higher prices.

- Supply: Mining output, recycling rates, and stockpiles play a crucial role in determining supply. A decline in supply can push prices upward.

- Geopolitical Events: Political instability, wars, and sanctions can create uncertainty and volatility in the global market, affecting prices.

- Economic Conditions: Global economic growth, interest rates, and inflation can influence investor sentiment towards gold and silver, impacting their prices.

2. Domestic Factors:

Domestic factors specific to India also play a significant role in shaping gold and silver rates.

- Import Duty: India levies import duty on gold and silver, which is factored into the final price. Changes in import duty can directly influence rates.

- Rupee-Dollar Exchange Rate: The value of the Indian Rupee against the US Dollar affects the cost of importing gold and silver, impacting domestic prices.

- Festivals and Religious Occasions: Demand for gold and silver jewelry surges during festivals like Diwali and weddings, leading to price fluctuations.

- Government Policies: Government policies related to gold import, taxation, and investment schemes can influence the market.

3. Market Speculation and Investor Sentiment:

Market speculation and investor sentiment play a crucial role in driving gold and silver prices.

- Investment Demand: Investors often view gold and silver as safe haven assets during times of economic uncertainty or inflation. Increased investment demand can push prices higher.

- Speculative Trading: Traders and investors engage in speculative trading, buying and selling based on price predictions. This activity can contribute to volatility.

4. Supply Chain Dynamics:

The supply chain for gold and silver in India involves various players, including importers, refiners, jewelers, and retailers.

- Importer Role: Importers bring gold and silver into India from international markets. Their pricing strategies and market dynamics influence domestic rates.

- Refiner Role: Refiners process imported gold and silver into standardized forms, contributing to price variations based on their refining costs and market demand.

- Jeweler Role: Jewelers play a significant role in shaping gold and silver demand. Their pricing strategies, design trends, and marketing efforts can influence consumer choices.

Impact of Gold and Silver Rates on Various Sectors:

1. Jewelry Industry:

Gold and silver are the cornerstone of India’s jewelry industry, contributing significantly to its economy. Fluctuations in their prices directly impact the industry’s profitability, consumer demand, and product pricing.

- Profitability: Jewelers face challenges in maintaining profitability when gold and silver prices rise.

- Consumer Demand: High prices can deter consumers from purchasing jewelry, impacting sales.

- Product Pricing: Jewelers must adjust their pricing strategies to reflect changes in metal rates, ensuring competitive advantage.

2. Investment Market:

Gold and silver are popular investment avenues in India, offering diversification and a hedge against inflation. Price fluctuations impact investor returns and decision-making.

- Investor Returns: Rising prices translate into higher returns for investors holding gold and silver.

- Investment Decisions: Investors closely monitor price trends to make informed investment decisions, considering factors like risk tolerance and market outlook.

3. Manufacturing and Technology:

Gold and silver find applications in various industries, including electronics, manufacturing, and healthcare. Price fluctuations impact production costs and product pricing.

- Production Costs: Increased metal prices can raise production costs for manufacturers, impacting profitability.

- Product Pricing: Companies may need to adjust product prices to reflect changes in input costs, potentially affecting competitiveness.

4. Central Bank Reserves:

Gold plays a crucial role in central bank reserves, serving as a reserve asset and a measure of economic strength. Price movements influence the value of these reserves.

- Reserve Value: Rising gold prices increase the value of central bank reserves, bolstering economic standing.

- Monetary Policy: Gold price fluctuations can influence monetary policy decisions, impacting interest rates and exchange rates.

Importance of Staying Informed about Gold and Silver Rates:

Staying informed about gold and silver rates is crucial for various stakeholders, including:

- Consumers: Understanding price trends allows consumers to make informed purchasing decisions, maximizing value and minimizing risk.

- Investors: Monitoring price movements helps investors make strategic investment choices, optimizing returns and managing risk.

- Businesses: Businesses involved in gold and silver trading, manufacturing, or jewelry retail need to track price fluctuations to adjust pricing strategies, manage inventory, and ensure profitability.

- Policymakers: Governments and central banks need to monitor gold and silver rates to understand their impact on the economy, inflation, and monetary policy.

FAQs on Gold and Silver Rates in India:

1. Where can I find the latest gold and silver rates in India?

The latest gold and silver rates in India are readily available from various sources, including:

- Reputable online portals: Websites of leading financial institutions, news agencies, and commodity exchanges provide real-time updates.

- Jewelry stores: Most jewelry stores display current gold and silver rates, allowing customers to assess prices before making purchases.

- Financial newspapers and magazines: These publications often feature sections dedicated to commodity prices, including gold and silver rates.

2. What factors affect the daily gold and silver rates in India?

Daily gold and silver rates in India are influenced by a combination of factors, including:

- Global market dynamics: International demand and supply forces, geopolitical events, and economic conditions significantly impact global prices, which in turn influence domestic rates.

- Domestic factors: Import duty, rupee-dollar exchange rate, festival demand, and government policies play a role in shaping Indian gold and silver prices.

- Market speculation and investor sentiment: Investor sentiment towards gold and silver, driven by factors like economic uncertainty and inflation, can influence price movements.

3. How can I invest in gold and silver in India?

There are various ways to invest in gold and silver in India, including:

- Physical gold and silver: Purchasing gold and silver coins, bars, or jewelry is a traditional investment method.

- Gold Exchange Traded Funds (ETFs): ETFs track the price of gold, offering a convenient and liquid way to invest.

- Gold and silver mutual funds: These funds invest in gold and silver assets, providing diversification and professional management.

- Digital gold and silver: Several platforms allow investors to buy and sell digital gold and silver, offering convenience and accessibility.

4. What are the risks associated with investing in gold and silver?

Investing in gold and silver involves certain risks, including:

- Price volatility: Gold and silver prices can fluctuate significantly, leading to potential losses.

- Storage costs: Physical gold and silver require secure storage, incurring costs.

- Liquidity risk: Selling large quantities of gold or silver can be challenging, potentially impacting liquidity.

- Counterparty risk: Investing in gold and silver through intermediaries like brokers or dealers carries counterparty risk.

5. What are the benefits of investing in gold and silver?

Investing in gold and silver offers potential benefits, including:

- Inflation hedge: Gold and silver are considered safe haven assets, potentially protecting investments from inflation.

- Diversification: Gold and silver can diversify investment portfolios, reducing overall risk.

- Portfolio stability: Gold and silver can provide stability to portfolios during market downturns.

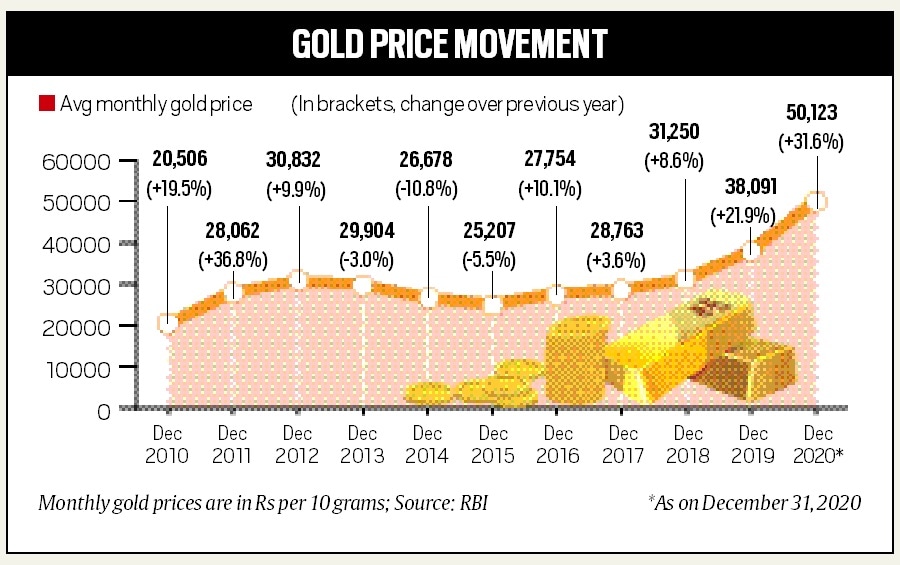

- Long-term growth potential: Historically, gold and silver have demonstrated long-term growth potential.

Tips for Investing in Gold and Silver:

- Do thorough research: Understand the market dynamics, investment options, and associated risks before investing.

- Set clear investment goals: Determine your investment objectives, risk tolerance, and time horizon.

- Diversify your portfolio: Allocate investments across various assets, including gold and silver, to mitigate risk.

- Consider investment options: Explore different investment avenues, such as physical gold, ETFs, mutual funds, and digital gold, to find the best fit for your needs.

- Monitor price movements: Stay informed about gold and silver price trends to make informed investment decisions.

- Consult a financial advisor: Seek advice from a qualified financial advisor to develop a personalized investment strategy.

Conclusion:

The price of gold and silver in India is influenced by a complex interplay of global and domestic factors. Understanding these dynamics is crucial for individuals, businesses, and policymakers alike. By staying informed about price trends, investment options, and associated risks, stakeholders can make informed decisions, maximize value, and navigate the fluctuating landscape of precious metals in India.

The importance of gold and silver in India extends beyond their economic value. These metals are deeply intertwined with cultural heritage, religious practices, and societal traditions. As such, their prices hold significant cultural and social implications, shaping the lives of millions of people. Understanding the factors driving gold and silver prices provides valuable insights into the economic, social, and cultural fabric of India.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Fluctuating Landscape of Gold and Silver Prices in India. We appreciate your attention to our article. See you in our next article!